MAY 15, 2025, 12:06 AM

Leading the Design Journey from Travel Services to Global Fintech

Leading the Design Journey from Travel Services to Global Fintech

Leading the Design Journey from Travel Services to Global Fintech

Leading the Design Journey from Travel Services to Global Fintech

I led a crucial design journey at Passpoint to navigate the traditional travel service provider to a fully committed fintech company. This re-orientation was driven by an agile response to market fit that has propelled us to over 700,000 transactions processed and 60,000 + cards created.

I led a crucial design journey at Passpoint to navigate the traditional travel service provider to a fully committed fintech company. This re-orientation was driven by an agile response to market fit that has propelled us to over 700,000 transactions processed and 60,000 + cards created.

I led a crucial design journey at Passpoint to navigate the traditional travel service provider to a fully committed fintech company. This re-orientation was driven by an agile response to market fit that has propelled us to over 700,000 transactions processed and 60,000 + cards created.

OVERVIEW

OVERVIEW

OVERVIEW

Passpoint began as a hybrid travel and fintech service aimed at making international travel a smooth experience. I orchestrated the design journey from our initial mobile application focused on flight and hotel bookings to our current fintech platform.

We have now processed over 700,000 transactions and supports 60,000+ cards, with the aim of positioning Passpoint as the go-to solution for global payment infrastructure. Learn more about Passpoint

Passpoint began as a hybrid travel and fintech service aimed at making international travel a smooth experience. I orchestrated the design journey from our initial mobile application focused on flight and hotel bookings to our current fintech platform.

We have now processed over 700,000 transactions and supports 60,000+ cards, with the aim of positioning Passpoint as the go-to solution for global payment infrastructure. Learn more about Passpoint

Passpoint began as a hybrid travel and fintech service aimed at making international travel a smooth experience. I orchestrated the design journey from our initial mobile application focused on flight and hotel bookings to our current fintech platform.

We have now processed over 700,000 transactions and supports 60,000+ cards, with the aim of positioning Passpoint as the go-to solution for global payment infrastructure. Learn more about Passpoint

Role

User research, IA, UX Design, Interaction, Visual design, Prototyping & Testing

September 2023 - Present

Role

User research, IA, UX Design, Interaction, Visual design, Prototyping & Testing

September 2023 - Present

Role

User research, IA, UX Design, Interaction, Visual design, Prototyping & Testing

September 2023 - Present

MY JOURNEY AT PASSPOINT

MY JOURNEY AT PASSPOINT

MY JOURNEY AT PASSPOINT

I joined Passpoint initially as an Associate Designer working alongside Deborah Dada the lead UX Designer, who was leading design efforts. When Deborah departed in September 2023, I stepped up to lead the design function at a critical juncture.

The company was preparing to go live with the Passpoint mobile product, because we needed to quickly establish our market presence. With a background in financial interfaces, I was uniquely positioned to guide the design direction during this pivotal period.

From associate design contributor to a leader, I lockstepped with our product team to define and refine our direction. This period of leadership coincided with our most significant strategic shift which was recognizing that our fintech features were driving adoption more than our travel services.

I've extremely grown over time, and achieved some key things

I joined Passpoint initially as an Associate Designer working alongside Deborah Dada the lead UX Designer, who was leading design efforts. When Deborah departed in September 2023, I stepped up to lead the design function at a critical juncture.

The company was preparing to go live with the Passpoint mobile product, because we needed to quickly establish our market presence. With a background in financial interfaces, I was uniquely positioned to guide the design direction during this pivotal period.

From associate design contributor to a leader, I lockstepped with our product team to define and refine our direction. This period of leadership coincided with our most significant strategic shift which was recognizing that our fintech features were driving adoption more than our travel services.

I've extremely grown over time, and achieved some key things

I joined Passpoint initially as an Associate Designer working alongside Deborah Dada the lead UX Designer, who was leading design efforts. When Deborah departed in September 2023, I stepped up to lead the design function at a critical juncture.

The company was preparing to go live with the Passpoint mobile product, because we needed to quickly establish our market presence. With a background in financial interfaces, I was uniquely positioned to guide the design direction during this pivotal period.

From associate design contributor to a leader, I lockstepped with our product team to define and refine our direction. This period of leadership coincided with our most significant strategic shift which was recognizing that our fintech features were driving adoption more than our travel services.

I've extremely grown over time, and achieved some key things

Delivered UI/UX designs for 4 major product iterations (Mobile, GO, Enterprise, Fintech) in 18 months, contributing to the platform

Delivered UI/UX designs for 4 major product iterations (Mobile, GO, Enterprise, Fintech) in 18 months, contributing to the platform

Delivered UI/UX designs for 4 major product iterations (Mobile, GO, Enterprise, Fintech) in 18 months, contributing to the platform

Optimized the card application flow based on merchant feedback, helping to drive 60,000+ new cards created and contributing to 700,000+ processed transactions in 2024

Optimized the card application flow based on merchant feedback, helping to drive 60,000+ new cards created and contributing to 700,000+ processed transactions in 2024

Optimized the card application flow based on merchant feedback, helping to drive 60,000+ new cards created and contributing to 700,000+ processed transactions in 2024

Redesigned the onboarding/KYC process, to increase conversion and support the launch of our new product line in Q1 2025

Redesigned the onboarding/KYC process, to increase conversion and support the launch of our new product line in Q1 2025

Redesigned the onboarding/KYC process, to increase conversion and support the launch of our new product line in Q1 2025

Created a design system with 80+ reusable components across our financial product suite (cards, multicurrency wallets, crypto wallets, virtual accounts), reducing design-to-development time by 30%

Created a design system with 80+ reusable components across our financial product suite (cards, multicurrency wallets, crypto wallets, virtual accounts), reducing design-to-development time by 30%

Created a design system with 80+ reusable components across our financial product suite (cards, multicurrency wallets, crypto wallets, virtual accounts), reducing design-to-development time by 30%

Sometimes leadership is handed to you, other times you have to seize it. I did both.

Sometimes leadership is handed to you, other times you have to seize it. I did both.

Sometimes leadership is handed to you, other times you have to seize it. I did both.

Our First Travel-Focused Product (PASSPOINT MOBILE)

Our First Travel-Focused Product (PASSPOINT MOBILE)

Our First Travel-Focused Product (PASSPOINT MOBILE)

Our initial mobile app targeted individual travelers and families, allowing them to book trips, manage travel needs, and access financial services in one platform. The sleek interface showcased both travel bookings and financial tools for smooth experiences.

First products are like first drafts, necessary but never the final story.

Our initial mobile app targeted individual travelers and families, allowing them to book trips, manage travel needs, and access financial services in one platform. The sleek interface showcased both travel bookings and financial tools for smooth experiences.

First products are like first drafts, necessary but never the final story.

Our initial mobile app targeted individual travelers and families, allowing them to book trips, manage travel needs, and access financial services in one platform. The sleek interface showcased both travel bookings and financial tools for smooth experiences.

First products are like first drafts, necessary but never the final story.

I created the foundation mobile app that combined travel services with financial tools, setting the stage for our journey.

I created the foundation mobile app that combined travel services with financial tools, setting the stage for our journey.

I created the foundation mobile app that combined travel services with financial tools, setting the stage for our journey.

MOVING ONTO A Merchant-Focused Web Platform (passpoint go)

MOVING ONTO A Merchant-Focused Web Platform (passpoint go)

MOVING ONTO A Merchant-Focused Web Platform (passpoint go)

After analyzing stakeholder feedback provided by our PM, Funmilola Joseph, I pivoted to design Passpoint GO, a web-based platform enabling travel agents to manage their business and book services for customers while accessing our financial tools for smoother operations.

The target audience shift changed everything about the design approach.

After analyzing stakeholder feedback provided by our PM, Funmilola Joseph, I pivoted to design Passpoint GO, a web-based platform enabling travel agents to manage their business and book services for customers while accessing our financial tools for smoother operations.

The target audience shift changed everything about the design approach.

After analyzing stakeholder feedback provided by our PM, Funmilola Joseph, I pivoted to design Passpoint GO, a web-based platform enabling travel agents to manage their business and book services for customers while accessing our financial tools for smoother operations.

The target audience shift changed everything about the design approach.

I translated business requirements into a complete web platform for travel merchants, addressing cost concerns with the initial mobile strategy.

I translated business requirements into a complete web platform for travel merchants, addressing cost concerns with the initial mobile strategy.

I translated business requirements into a complete web platform for travel merchants, addressing cost concerns with the initial mobile strategy.

Responding to Usage Patterns PASSPOINT 1.0 BETA WAS BIRTHED

Responding to Usage Patterns PASSPOINT 1.0 BETA WAS BIRTHED

Responding to Usage Patterns PASSPOINT 1.0 BETA WAS BIRTHED

Our analytics revealed users were gravitating toward our fintech features more than travel services. So we decided to redesign the platform to maintain travel functionality while enhancing and highlighting the financial services that were gaining traction with our user base.

I proceeded to redesign the navigation and information architecture to emphasize financial services while preserving travel functionality.

Our analytics revealed users were gravitating toward our fintech features more than travel services. So we decided to redesign the platform to maintain travel functionality while enhancing and highlighting the financial services that were gaining traction with our user base.

I proceeded to redesign the navigation and information architecture to emphasize financial services while preserving travel functionality.

Our analytics revealed users were gravitating toward our fintech features more than travel services. So we decided to redesign the platform to maintain travel functionality while enhancing and highlighting the financial services that were gaining traction with our user base.

I proceeded to redesign the navigation and information architecture to emphasize financial services while preserving travel functionality.

Fintech-First Approach with passpoint 2.0 beta

Fintech-First Approach with passpoint 2.0 beta

Fintech-First Approach with passpoint 2.0 beta

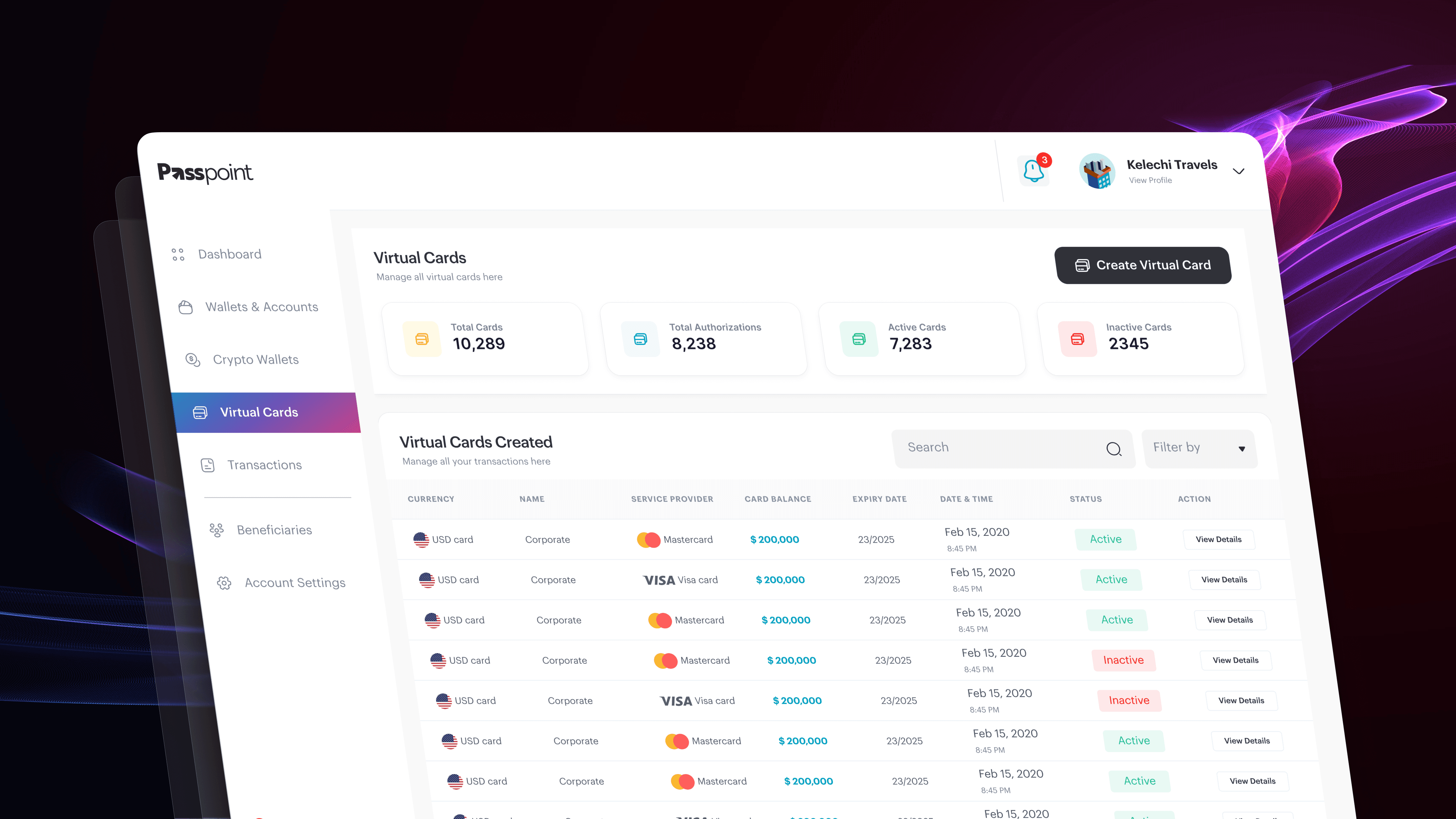

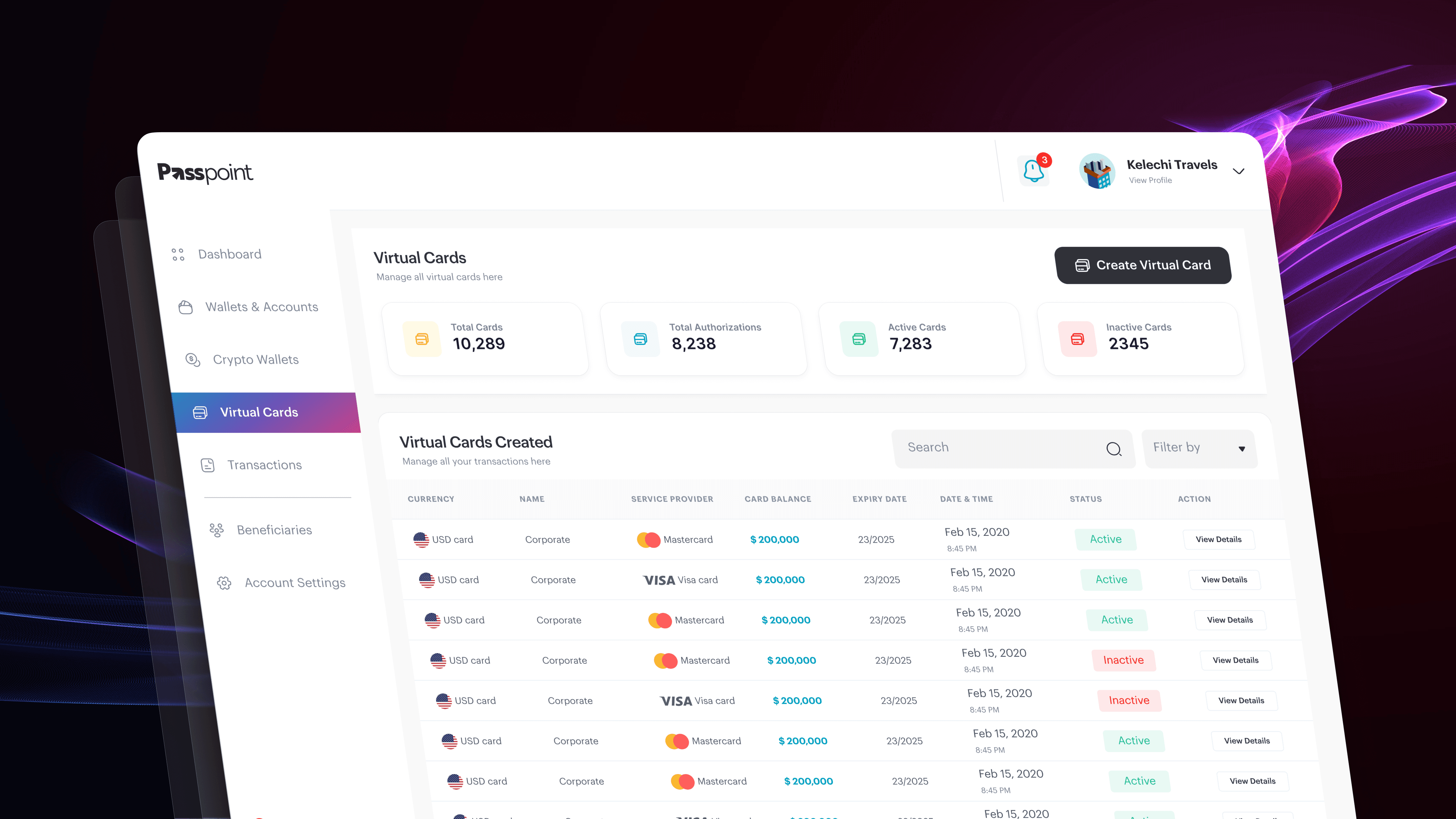

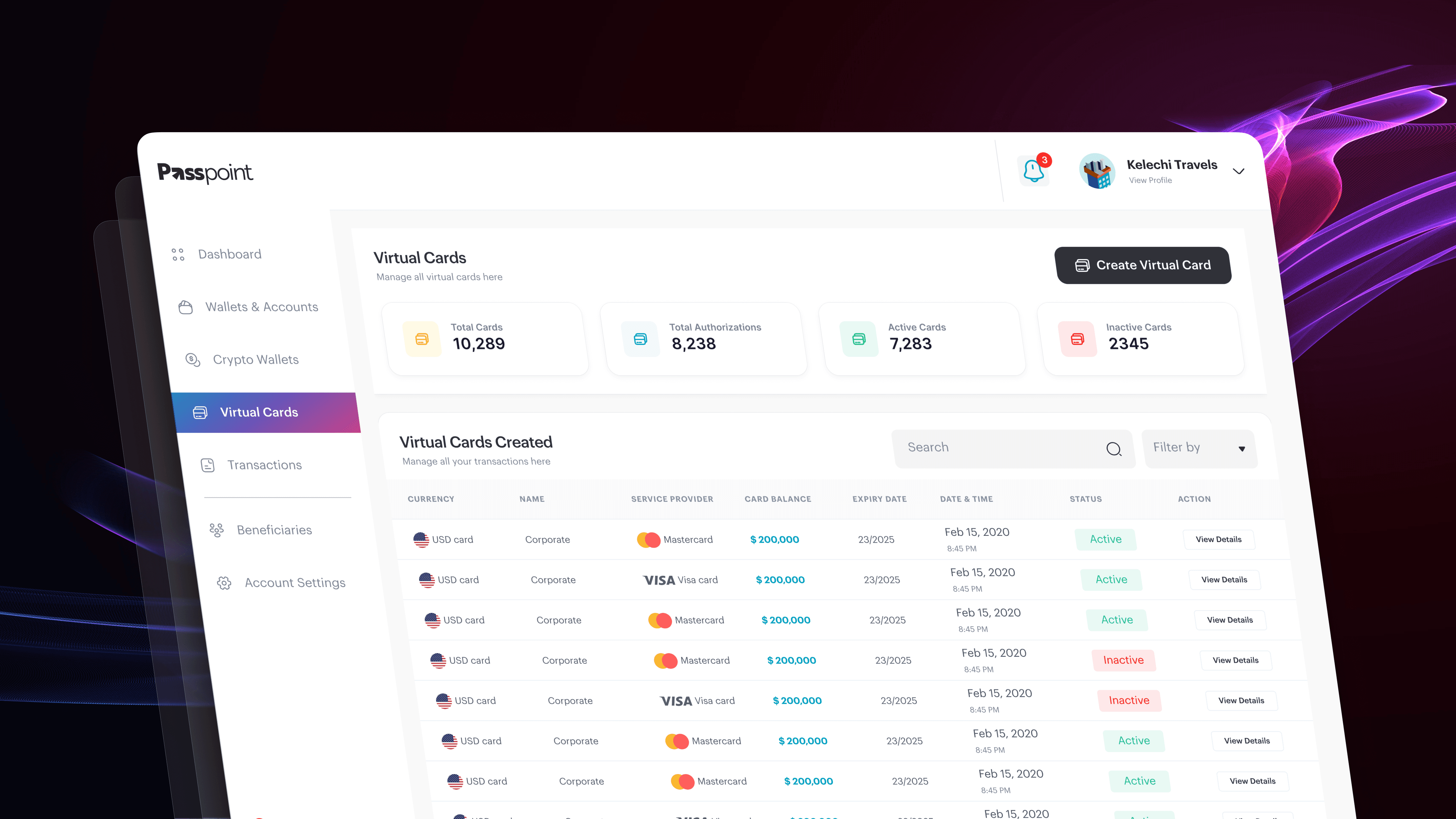

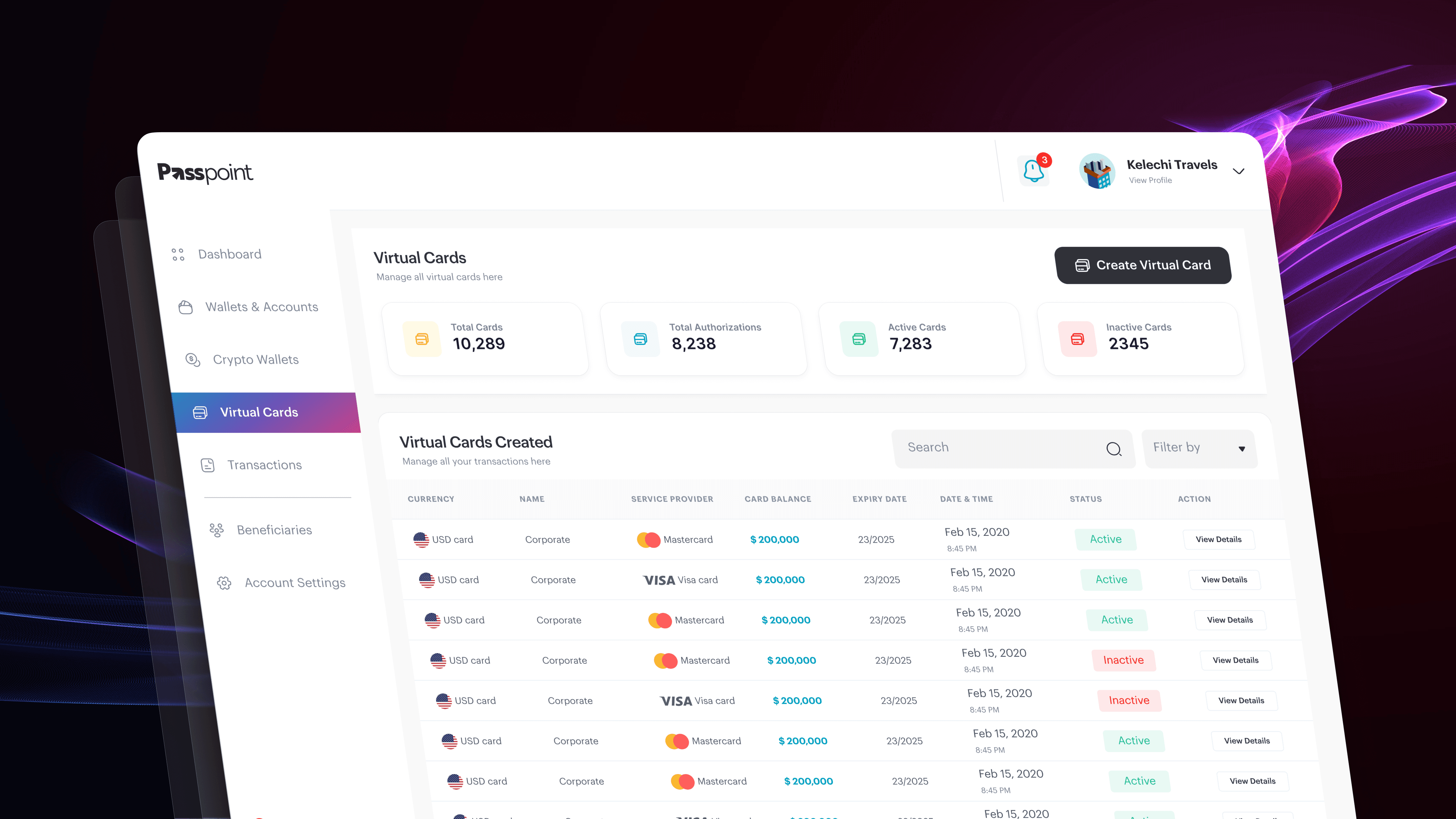

With Passpoint 2.0 beta, I further optimized the platform to foreground financial services while maintaining travel as a secondary offering. This version featured optimized card management, multicurrency wallets, and a more intuitive financial dashboard.

It was about finding what works and doubling down, our financial tools were clearly resonating and perfoming.

With Passpoint 2.0 beta, I further optimized the platform to foreground financial services while maintaining travel as a secondary offering. This version featured optimized card management, multicurrency wallets, and a more intuitive financial dashboard.

It was about finding what works and doubling down, our financial tools were clearly resonating and perfoming.

With Passpoint 2.0 beta, I further optimized the platform to foreground financial services while maintaining travel as a secondary offering. This version featured optimized card management, multicurrency wallets, and a more intuitive financial dashboard.

It was about finding what works and doubling down, our financial tools were clearly resonating and perfoming.

I had also updated the design system and UI Component kits to adjust fully into fintech feel

I had also updated the design system and UI Component kits to adjust fully into fintech feel

I had also updated the design system and UI Component kits to adjust fully into fintech feel

passpoint enterprise, Corporate Travel & Expense Management

passpoint enterprise, Corporate Travel & Expense Management

passpoint enterprise, Corporate Travel & Expense Management

In order not to phase out our travel services completely, We iterated and I designed a dedicated solution for companies to manage both travel bookings and financial expenses in one platform, creating distinct workflows for approval processes, reporting, and compliance requirements specific to business users.

In order not to phase out our travel services completely, We iterated and I designed a dedicated solution for companies to manage both travel bookings and financial expenses in one platform, creating distinct workflows for approval processes, reporting, and compliance requirements specific to business users.

In order not to phase out our travel services completely, We iterated and I designed a dedicated solution for companies to manage both travel bookings and financial expenses in one platform, creating distinct workflows for approval processes, reporting, and compliance requirements specific to business users.

Enterprise UX requires thinking in systems, not just screens.

Enterprise UX requires thinking in systems, not just screens.

Enterprise UX requires thinking in systems, not just screens.

Full Commitment to Financial Services

Full Commitment to Financial Services

Full Commitment to Financial Services

Following our strategic pivot to discontinue travel services, I redefined our platform to focus exclusively on fintech offerings, cards, multicurrency wallets, crypto capabilities, and virtual accounts with a cohesive, streamlined user experience.

Sometimes success means letting go of your original vision. Because by the end of Q4 2024 we have been able to achieve:

Following our strategic pivot to discontinue travel services, I redefined our platform to focus exclusively on fintech offerings, cards, multicurrency wallets, crypto capabilities, and virtual accounts with a cohesive, streamlined user experience.

Sometimes success means letting go of your original vision. Because by the end of Q4 2024 we have been able to achieve:

Following our strategic pivot to discontinue travel services, I redefined our platform to focus exclusively on fintech offerings, cards, multicurrency wallets, crypto capabilities, and virtual accounts with a cohesive, streamlined user experience.

Sometimes success means letting go of your original vision. Because by the end of Q4 2024 we have been able to achieve:

745,000 +

745,000 +

745,000 +

transactions were processed

transactions were processed

transactions were processed

62,000 +

62,000 +

62,000 +

cards were created

cards were created

cards were created

The goal was to get the best of both worlds which is the interoperability of between traditional currencies and cryptocurrencies

The goal was to get the best of both worlds which is the interoperability of between traditional currencies and cryptocurrencies

The goal was to get the best of both worlds which is the interoperability of between traditional currencies and cryptocurrencies

Reintroducing Passpoint as a Fintech Leader

Reintroducing Passpoint as a Fintech Leader

Reintroducing Passpoint as a Fintech Leader

As we pivoted away from travel services, I designed our new corporate website to establish Passpoint's identity as a fintech platform. The site clearly communicated our value proposition, showcased our financial products, and supported lead generation efforts.

I believe website is often the first impression, so I make it count.

As we pivoted away from travel services, I designed our new corporate website to establish Passpoint's identity as a fintech platform. The site clearly communicated our value proposition, showcased our financial products, and supported lead generation efforts.

I believe website is often the first impression, so I make it count.

As we pivoted away from travel services, I designed our new corporate website to establish Passpoint's identity as a fintech platform. The site clearly communicated our value proposition, showcased our financial products, and supported lead generation efforts.

I believe website is often the first impression, so I make it count.

Key Takeaways from the Journey

Key Takeaways from the Journey

Key Takeaways from the Journey

Quick adaptation to user feedback and market trends was crucial. Our ability to pivot from a travel-centric to a fintech-focused approach without losing user trust was a testament to our robust design and strategic foresight.

User flows were continuously optimized based on real-time data, which significantly enhanced user satisfaction and retention rates. For instance, the redesign of our card application flow reduced user drop-off and increased card activation.

Detailed analytics helped identify that our fintech services were utilized three times more than travel services, guiding our pivot decision.

Post-pivot, our transaction volume increased exponentially, showcasing the effectiveness of focusing on our financial services.

As we look forward, Passpoint aims to integrate more AI-driven tools to personalize financial services, predicting and catering to user needs even before they arise.

Quick adaptation to user feedback and market trends was crucial. Our ability to pivot from a travel-centric to a fintech-focused approach without losing user trust was a testament to our robust design and strategic foresight.

User flows were continuously optimized based on real-time data, which significantly enhanced user satisfaction and retention rates. For instance, the redesign of our card application flow reduced user drop-off and increased card activation.

Detailed analytics helped identify that our fintech services were utilized three times more than travel services, guiding our pivot decision.

Post-pivot, our transaction volume increased exponentially, showcasing the effectiveness of focusing on our financial services.

As we look forward, Passpoint aims to integrate more AI-driven tools to personalize financial services, predicting and catering to user needs even before they arise.

Quick adaptation to user feedback and market trends was crucial. Our ability to pivot from a travel-centric to a fintech-focused approach without losing user trust was a testament to our robust design and strategic foresight.

User flows were continuously optimized based on real-time data, which significantly enhanced user satisfaction and retention rates. For instance, the redesign of our card application flow reduced user drop-off and increased card activation.

Detailed analytics helped identify that our fintech services were utilized three times more than travel services, guiding our pivot decision.

Post-pivot, our transaction volume increased exponentially, showcasing the effectiveness of focusing on our financial services.

As we look forward, Passpoint aims to integrate more AI-driven tools to personalize financial services, predicting and catering to user needs even before they arise.

you will also love…

you will also love…

you will also love…

reimagining Nurse Workflow Efficiency with Voice-Activated Healthcare Tools

reimagining Nurse Workflow Efficiency with Voice-Activated Healthcare Tools

reimagining Nurse Workflow Efficiency with Voice-Activated Healthcare Tools

reimagining Nurse Workflow Efficiency with Voice-Activated Healthcare Tools

WRITE ME, I WRITE BACK

© 2025 Designed & Developed In Love and Honesty to Grow.

WRITE ME, I WRITE BACK

© 2025 Designed & Developed In Love and Honesty to Grow.

WRITE ME, I WRITE BACK

© 2025 Designed & Developed In Love and Honesty to Grow.

WRITE ME, I WRITE BACK

© 2025 Designed & Developed In Love and Honesty to Grow.